Cornell University ILR School

DigitalCommons@ILR

Federal Publications

Key Workplace Documents

Competitive Conditions for Foreign Direct Investment in India

Laura Bloodgood

U.S. International Trade Commission

Abstract

Net foreign direct investment (FDI) flows into India reached $15.7 billion in India’s 2006-07 fiscal year, more than triple the $4.7 billion recorded during 2005-06, with the largest share of FDI flows from Mauritius, followed by the United States and the United Kingdom. This study examines FDI in India, in the context of the Indian economic and regulatory environment. We present FDI trends in India, by country and by industry, using official government data from India, the United States, and international organizations. To supplement the official data, the study also discusses specific investment activities of multinational companies in India, representing a wide range of countries and industries. To illustrate the driving forces behind these trends, the study also discusses the investment climate in India, Indian government incentives to foreign investors, particularly Special Economic Zones, the Indian regulatory environment as it affects investment, and the effect of India’s global, regional, and bilateral trade agreements on investment from the United States and other countries. Finally, the study presents two case studies. The first examines global FDI in India’s automobile industry. The second analyzes the effects of India’s 2005 Patent Law on FDI in the pharmaceutical industry.

Keywords

India, economic growth, foreign investment, trade

Disciplines

Economics | International Economics | Social and Behavioral Sciences

Comments

Suggested Citation

Bloodgood, L. (2007). Competitive conditions for foreign direct investment in India (ITC Publication No. 3931). Washington, DC: Office of Industries, United States International Trade Commission. https://digitalcommons.ilr.cornell.edu/key_workplace/389/

Excerpt from Page 2-23

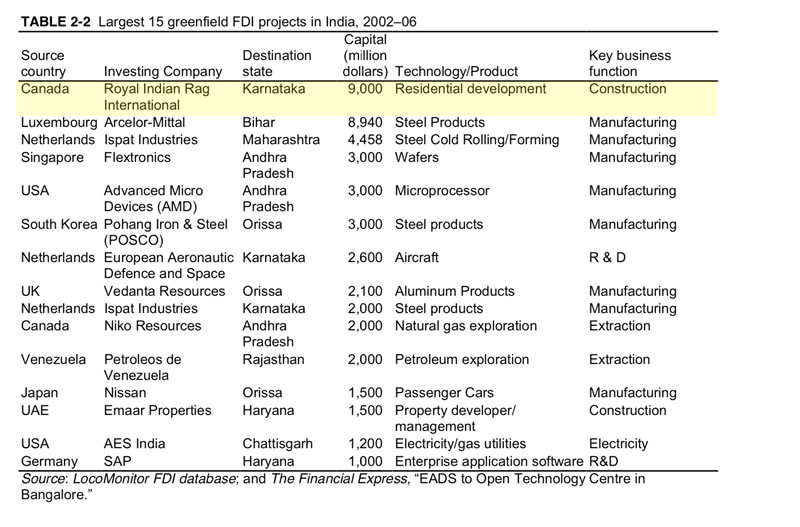

The heavy industry and transport equipment sectors together attracted over $30 billion in greenfield FDI projects in 2006. The cluster with the highest reported value during 2002–06 is heavy industry. Projects in this sector tend to be highly capital intensive, with single projects frequently requiring upwards of $6 billion in startup investment costs. The largest recent examples include the POSCO and Arcelor-Mittal Steel projects noted above, and Vedanta Resources’ (United Kingdom) aluminum smelter project, all planned for the state of Orissa.62 Reported greenfield FDI in the transport equipment sector exceeded $11 billion in 2006.63

Another major recipient sector was property, tourism and leisure, with over $6.1 billion in 2006. This level of investment was well above the annual average for this sector, although still below the high of $9.2 billion in 2004. The Asian tsunami on December 26, 2004, may have dampened enthusiasm for such investment, as investment plunged to just over $100 million in 2005 before rebounding to $6.1 billion in 2006. The industry is expected to continue to attract substantial FDI. At least 50 non-Indian hotel chains planned to enter the market as of April 2007, targeting India’s low level of hotel penetration around the country.64 In particular, Royal Indian Raj International Corp. has signed a contract with Choice Hotels to build 15,000 hotel rooms around the country, with an estimated FDI value of $6 billion.65

Figure 2-13 shows that greenfield FDI projects have become more widely distributed across industries over time. In 2002, FDI projects were concentrated in the ICT industry, followed by business and financial services; and electronics. By 2006, the distribution of the projects among the clusters was more uniform, although the ICT cluster still was the largest. Figure 2-14 shows how greenfield FDI capital has been distributed among the various sectors. Note that the two “pies” are not the same size–the total amount invested in 2006 ($55.5 billion) is more than 13 times the total in 2002 ($4.2 billion). Even if an industry’s share of the total pie decreased between 2002 and 2006, that industry may still have significantly increased its total greenfield FDI. The ICT sector is a case in point, down 12 percent by relative share from 2002 to 2006, but recording increased FDI of more than $4.1 billion.

Excerpt from Page 2-7